Additional Information Required for International Orders

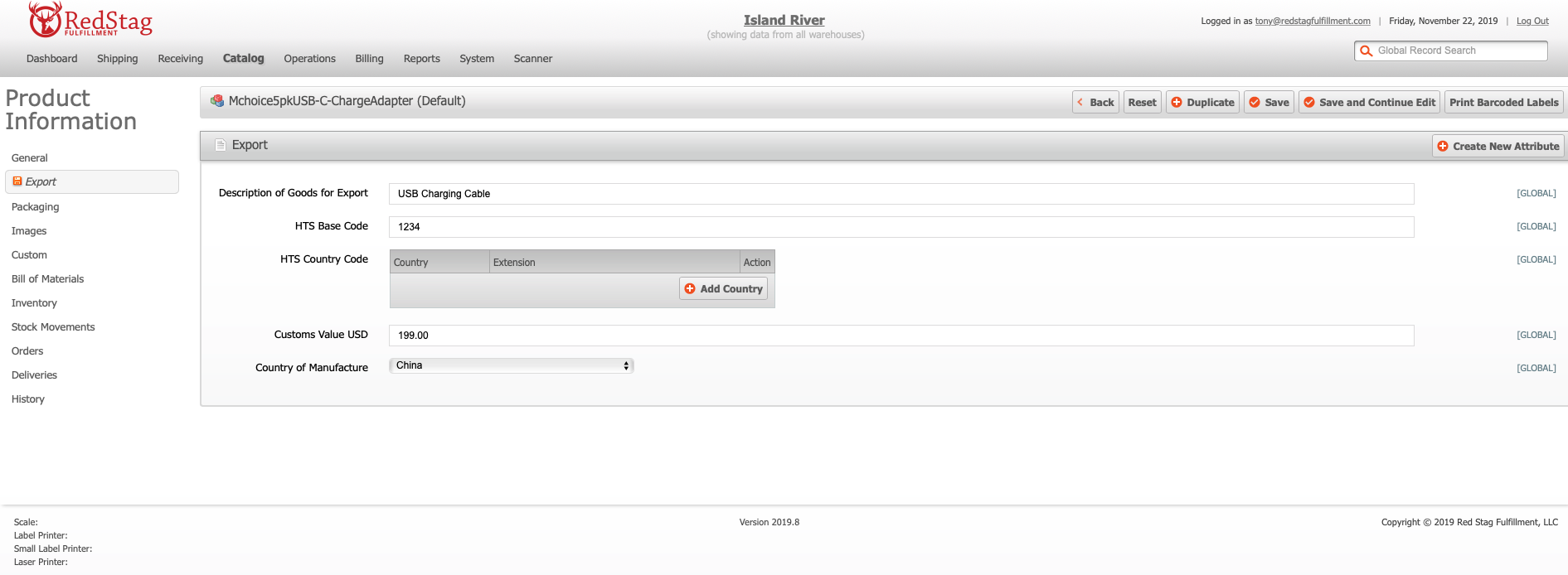

If you plan to ship orders outside of the United States, you will be required to enter additional information for each of your SKUs. To do this, you will go to:

- Catalog > Manage Products

- Select a SKU/Product

- Click the “Export” button in the left sidebar

- Fill out the required information as well as the additional information if you have it available for reference (*Required):

- Description of Goods for Export*: Use a few words or a phrase to describe the product. A good rule of thumb is for this to include what the product is made of and what the product is used for.

- HTS Base Code: An HTS code stands for Harmonized Tariff Schedule. The first 6 digits of the code is a universal standard (referred to as the HS Code). This code determines the tariff/duty rate of the traded product and keeps records of international trade stastics that are used in nearly 200 countries. You can learn more about these codes here and search for a code using the Harmonized Tarrif Schedule Search provided by the US International Trade Commission.

- HTS Country Code: Though the first six digits are universally accepted, the 1 to 4 digits after the HTS Base Code are country specific.

- Customs Value USD*: This is the retail cost of the product. In other words, this is what your customer pays for this product. It is very important that this information is accurate, as each country will use this as the base for which to tax the product.

- Country of Manufacture*: Please select the country where this product was manufactured.